It’s been a wild ride for interest rates in the last few weeks, and the moves have been attributed to some extent to the banking turmoil and lack of confidence. Today the FED increased rates, and tomorrow the Bank of England meets to review UK base rates. What will they do and what impact would an increase have right now?

Base rate rises to 4.25% - this will have a significant impact on millions but will it bring down inflation sufficiently?

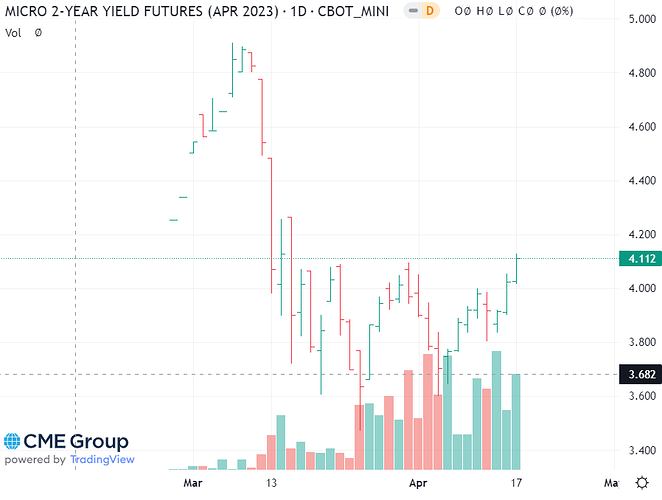

Interest rate futures in USD has fallen in value by about 15% since March, This is either an indication things are slowly normalising, or a reminder of how precarious the markets had become back in March.

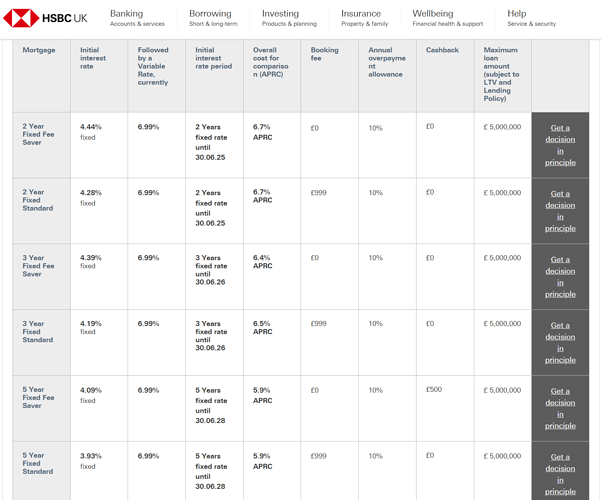

Ever wondered what an inverted yield curve looks like? Just look at current mortgage rates where it costs less to borrow for longer. This is the oppositive to the usual situation where a borrower paya a premium for fixing their repayments for a longer time. At the moment it is riskier for the lender to provide short term debt as the long term expectation is for rates to reduce from their current highs.

Hopefully rates will fall. Bonds yields are currently dropping

Welcome to the community @spackmanchris. Lower rates will be good new for borrowers, and generally good news for the economy. The trajectory at the moment does seem to be downwards, however there are also concerns at the moment around supply chain disruption. Perhaps we have another spike ahead of us?